JPMorgan still processed Epstein payments amounting to $1.1M after closing his account – most of them to women or girls

08/04/2023 / By Belle Carter

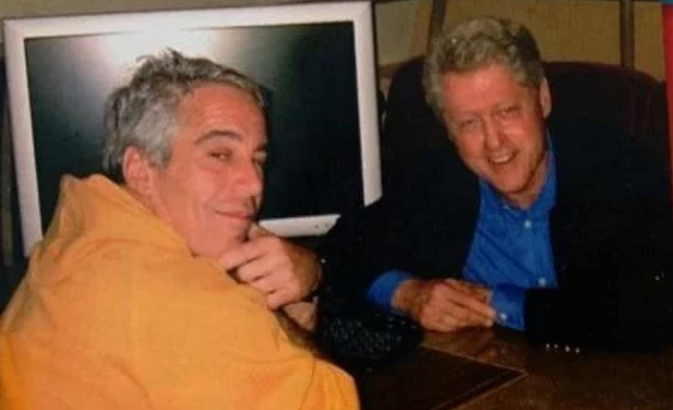

Financial giant JPMorgan Chase still processed over $1.1 million in payments from convicted sex offender Jeffrey Epstein to women – or girls – with Eastern European surnames even after closing his account.

Attorney Linda Singer, who represents the U.S. Virgin Islands (USVI), put forward this claim in a July 31 filing before Manhattan federal judge Jed Rakoff. According to her, more than $320,000 of the roughly $1.1 million worth of transactions involved “numerous individuals for whom JPMorgan had no previously identified payments.”

The lawyer referenced a spreadsheet prepared by JPMorgan listing the dates and beneficiaries of more than 9,000 transactions payable to Epstein-related individuals. The transactions – all conducted between 2005 and 2019 – “had a combined value of over $2.4 billion.”

Epstein lived on the private island of Little St. James in the USVI, where he sexually abused women. While living there, he also kept tens of millions of dollars on deposit at JPMorgan. Though the New York City-based bank claimed to have cut ties with him in 2013, Singer’s filing proved otherwise. (Related: Same JPMorgan Chase that just de-banked Dr. Mercola and his staff worked closely with pedophile Jeffrey Epstein to enable child trafficking.)

Singer accused the bank of failing to disclose the payments until after the end of discovery, the period in a lawsuit when parties exchange evidence. She wrote: “Many of the entries reflected accounts and payments, numbering in the thousands and totaling in the hundreds of millions of dollars in value, of which USVI had no prior knowledge or information from JPMorgan’s responses and productions during the fact discovery period.”

The lawyer asked Rakoff in her filing to fine JPMorgan for not providing the required information during the fact discovery period. She also requested the court to order the bank to turn over “all financial records for any newly disclosed girls or women to whom Epstein made payments” at the soonest.

JPMorgan CEO: Epstein scandals negatively impacted bank’s image

Patricia Wexler, a spokeswoman for the bank, swiftly denied Singer’s allegations. She argued: “There is no proof this is accurate. Epstein had no accounts with us after we exited him. These accounts were at other banks.”

Meanwhile, JPMorgan CEO Jamie Dimon admitted on Aug. 2 that the Epstein-related lawsuits against the bank have impacted its brand equity “a little bit.”

“We banked Jeffrey Epstein and I’m so sorry that we did. I wish we hadn’t,” he told CNBC‘s Leslie Picker. “Had we known then what we know today, we obviously wouldn’t have. Yes, we make terrible mistakes sometimes and we apologize for it.”

A separate lawsuit by the USVI’s government against the bank is scheduled to be heard this fall. This second suit accused JPMorgan of retaining Epstein as a client despite multiple red flags being raised internally about him over the years. JPMorgan has denied any wrongdoing in this case as well.

Epstein killed himself in a Manhattan federal jail in August 2019, a month after he was arrested on child sex trafficking charges. Eleven years prior, he had pleaded guilty in 2008 to a Florida state charge of soliciting sex from a minor

Asked if they have changed the way they vet potential clients, Dimon replied in the affirmative.

“Yes, because we have to be very careful again, we can’t kick out people based on allegations, but again, yes, I think we can do more, particularly around a whole bunch of things,” he told Packer.

Visit Epstein.news for more stories about the late convicted sex offender and his links to JPMorgan.

Watch Jason Bermas discussing the mainstream media’s refusal to touch on Jeffrey Epstein’s work with big banks below.

This video is from the Red Voice Media channel on Brighteon.com.

More related stories:

New emails reveal deep ties between Jeffrey Epstein and former CEO of JPMorgan, Barclays.

Accessory to the crime: JPMorgan Chase settles massive lawsuit with victims of Jeffrey Epstein.

Academics received money from Epstein even after the late sex offender’s pedophilia conviction.

Sources include:

Submit a correction >>

Tagged Under:

bank accounts, conspiracy, corruption, crime, deception, evil, finance, finance riot, Jamie Dimon, Jeffrey Epstein, JPMorgan Chase, lawsuit, lies, Linda Singer, money supply, payment processing, Pedophilia, rigged, risk, sexual trafficking, traitors, transactions, twisted, US Virgin Islands

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 FinanceRiot.com

All content posted on this site is protected under Free Speech. FinanceRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FinanceRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.