Doomsday CEO Bob Nardelli says U.S. economy “ready to crack”

06/03/2024 / By Ethan Huff

If the United States economy was a giant fault line, then, well, the earthquake rumbling has already begun.

According to Bob Nardelli, the former boss of Home Depot and Chrysler, the U.S. economy is “ready to crack” – and he should know, seeing as how he correctly predicted the retail apocalypse.

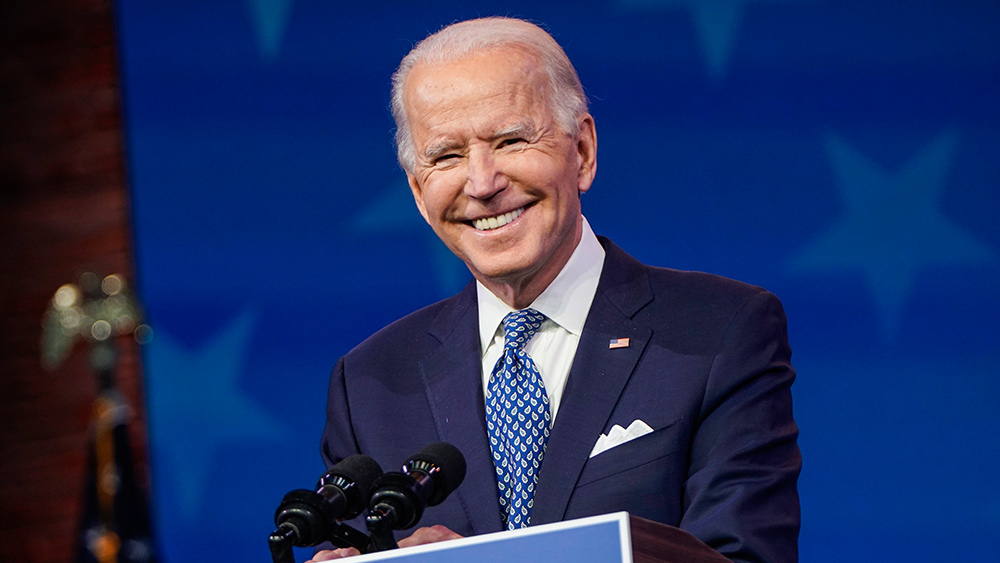

Blaming much of the current troubles on President Biden, Nardelli worries that things are about to get a whole lot worse for the financial system, especially if Biden wins reelection.

Even if President Trump or Robert F. Kennedy Jr. were to win in 2024, either guy has a tall order coming to him once the economic house of cards really gets to tumbling.

“What I’ve seen over the past three-and-a-half years is that a series of debacles and missteps have created a tremendous pressure on the fault lines of our economy, and they’re about ready to crack,” Nardelli told FOX Business.

“Whoever gets the next stint in the White House is going to be hit with a wrecking ball in trying to correct the missteps and the overspending of this current administration. So we’re in for a rough time, I would say.”

(Related: If he can get away with it, billionaire eugenicist Bill Gates will unleash “Pandemic 2” to finish the economic destruction job that was started with Pandemic 1, also known as the Wuhan coronavirus [COVID-19] “pandemic.”)

Unless things change course, say goodbye to prosperity

Last April, Nardelli spoke publicly about the troubles America’s retail industry was facing, warning that “we’re going to see a lot of bankruptcies,” which is what happened.

Since Nardelli said all that, more than 5,000 U.S. stores closed in 2023, with another 3,600 closing just in the first four months of 2024.

When asked on FOX what he thinks about Biden’s so-called “green” agenda since assuming office in January 2021, Nardelli responded by pointing at the dire state of the U.S. consumer and struggling American families at large.

“The inflation pipeline has a long tail and I’ve seen it across many areas, both on raw materials and labor,” Nardelli said, noting that Biden’s “war on fossil fuels” has massively driven up energy prices, along with prices for groceries and rent.

“It’s really depressing to see the impact on family net worth and income levels.”

As for wages going up slightly, supposedly, Nardelli says this is not nearly enough to keep Americans healthy and prosperous like they once were.

“Even though we’ve seen 40 percent wage increases in some cases, it’s being totally absorbed by inflation and the cost of living,” he said.

During the Biden years, the average American household’s net worth has stagnated, at best. This, says JPMorgan Chase CEO Jamie Dimon, is part of the “hard landing” that is probably coming for the U.S. economy.

That hard landing could also be accompanied by stagflation, Dimon told CNBC, this being an economic situation marked by ever-rising inflation and rising unemployment.

The last time the U.S. economy saw stagflation was back in the 1970s. It is worse than a recession and is typically accompanied by a plunging stock market and everything attached to that stock market, i.e., 401k and retirement savings.

The current U.S. economy, Dimon said in another interview, “looks more like the ’70s than we’ve seen before.”

Though the stock market is hovering around record highs, it could, and likely will, take a major turn for the worse that will catch many by surprise. Top Citigroup U.S. economist Andrew Hollenhorst says the fault line cracks in the economy that many are seeing could accelerate into a “snowball” rather quickly, which would ensure a very “hard landing.”

The latest news about the crumbling U.S. economy can be found at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

Biden, Bob Nardelli, CEO, Chrysler, collapse, dollar demise, economic riot, economy, Home Depot, inflation, money supply, pensions, retail apocalypse, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 FinanceRiot.com

All content posted on this site is protected under Free Speech. FinanceRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FinanceRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.