War between the U.S. and China over Taiwan could cost the global economy a staggering $10 TRILLION

01/12/2024 / By Kevin Hughes

A war over Taiwan between the United States and China could cost an unimaginable $10 trillion, equal to about 10 percent of the global GDP, dwarfing the impact of the Wuhan coronavirus (COVID-19) pandemic and the 2008 Global Financial Crisis.

This is according to an analysis conducted by Bloomberg Economics, which noted that both the Global Financial Crisis and the COVID-19 pandemic only affected global GDP by about 5.9 percent each.

Bloomberg Economics modeled two scenarios and their estimated impact on global GDP: A Chinese invasion that draws the U.S. into a hot conflict with Beijing, and a blockade that cuts Taiwan off from trade with the rest of the world.

The biggest impact comes from the blow to the world’s supply of semiconductors, disruption to shipping in the region, trade sanctions and tariffs and the impact of a war between the world’s two superpowers on global financial markets.

Taiwan makes most of the world’s advanced logic semiconductors. Around 5.6 percent of the island nation’s total value added to the global economy comes from sectors using chips as direct inputs – worth an estimated $6 trillion. Total market cap for the top 20 customers of Taiwanese semiconductor manufacturing giant, the Taiwan Semiconductor Manufacturing Co., is around $7.4 trillion.

Tensions between China and Taiwan have been increasing in recent years and the future of cross-Strait relations are currently on the ballot in Taiwan, which is set to elect a new president on Jan. 13. If polls are to be believed, frontrunner and current Vice President Lai Ching-te of the more independence-minded Democratic Progressive Party is expected to win the race.

This possibility deeply concerns Chinese President Xi Jinping, who sees Lai as another obstacle toward reunifying the self-governing island. Lai’s opponents have both promised to be “pragmatic” about Taiwan’s future and have vowed to improve relations with China.

Invasion of Taiwan would immediately devastate the economies of China and the U.S.

In the event of a war that involves People’s Liberation Army units invading Taiwan, the self-governing and democratic island nation’s economy would be devastated. Bloomberg Economics estimates that the country’s GDP would shrink by at least 40 percent. The fact that Taiwan’s population and industrial base are concentrated on the coast facing the mainland would add to the human and economic cost.

Following an invasion of Taiwan, China’s major trade partners – including the U.S. – would likely react by cutting off most if not all trade with the mainland. China’s GDP is expected to suffer by nearly 17 percent, or around $3 trillion, according to China’s 2022 nominal GDP.

The U.S., while far from the center of the fighting, still has a lot at stake. Many of America’s most valuable corporations rely on semiconductor exports from Taiwan. The cut in U.S.-China trade and the likely imposition of tariffs on Beijing would shrink the U.S. economy by 6.7 percent, or $1.7 trillion, according to America’s 2022 nominal GDP.

Outside of China and the U.S., the economies of South Korea, Japan and Southeast Asia would be the most impacted and would contribute heavily to the 10.2 percent reduction in global GDP.

This model only predicts the impact to the global economy following one year of conflict. In the event of a yearlong blockade of Taiwan by China, Bloomberg Economics expects Taiwan’s economy, which has thrived through trade and the export of valuable commodities, to drop by 12.2 percent.

For China, the U.S. and the world as a whole, a blockade would be less devastating to the global economy, with GDP in the first year dropping by 8.9 percent, 3.3 percent and five percent, respectively – nearly as much of an impact to the global economy as the Great Recession and the COVID-19 pandemic.

Follow CommunistChina.news for more news about China and its relationship with Taiwan.

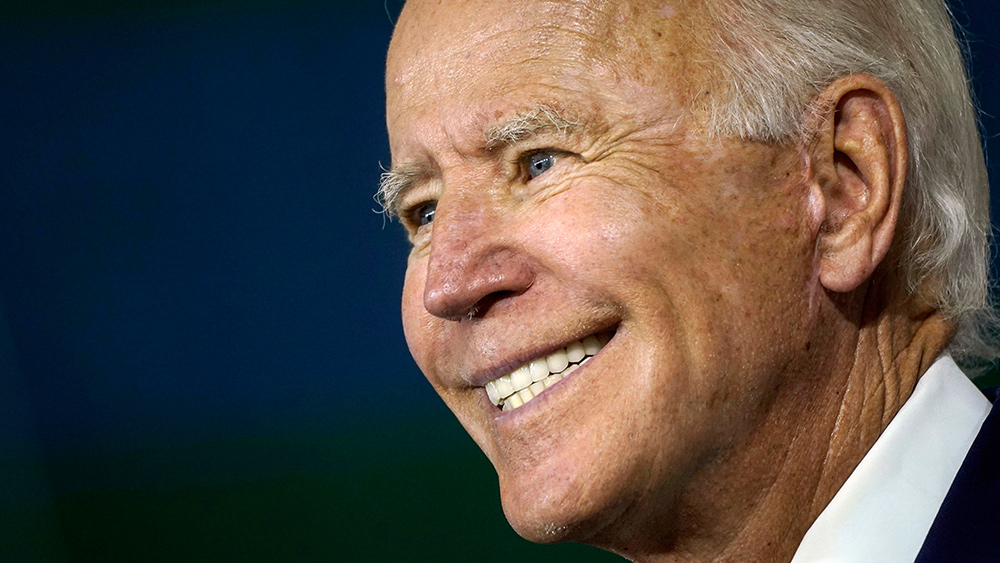

Watch the video below about Xi Jinping allegedly telling Joe Biden he plans to “peacefully” take Taiwan.

This video is from the NewsClips channel on Brighteon.com.

More related articles:

Think tank: America’s defense industry is not prepared for a war with China over Taiwan.

Two Chinese balloons spotted flying over Taiwan ahead of the island nation’s presidential election.

Sources include:

Submit a correction >>

Tagged Under:

big government, blockade, bubble, chaos, China, Chinese invasion of Taiwan, collapse, debt bomb, debt collapse, economic collapse, economic riot, economics, economy, finance, finance riot, financial crash, global GDP, national security, risk, semiconductors, supply chain, Taiwan, Taiwan invasion, WWIII, Xi Jinping

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 FinanceRiot.com

All content posted on this site is protected under Free Speech. FinanceRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FinanceRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.