Record number of homes for sale seeing substantial price DROPS as housing market falters

07/15/2024 / By Ethan Huff

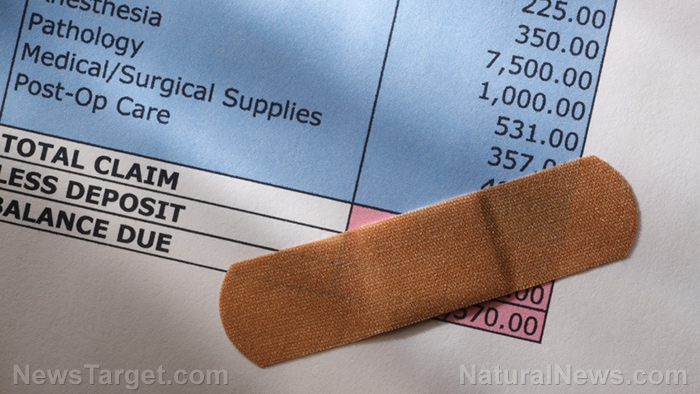

Just like what started to happen in the lead-up to the 2008 financial crisis, housing prices across the United States in 2024 are staggering as a record number of homes for sale see massive price drops.

Up until now, those in the top one percent with plenty of cash on hand have been gobbling up real estate like it is nobody’s business, creating record-high home prices that the other 99 percent can no longer afford. We are starting to see cracks at the top, though, as even the richest among us are no longer purchasing homes at sky-high prices, which could mean a housing collapse is soon on the way.

Widely recognized among economists and financial experts as the most tangible leading indicator for the broader economy, housing is a canary in the coalmine, so to speak, in terms of what we can expect to see happen next for the rest of the economy. If housing falls, so does everything else, in other words.

The latest Case Shiller numbers reveal that the Composite 20 city index posted its first year-over-year decline since early 2023. Average home sale prices are hitting new all-time highs, but the number of actual home sale transactions being completed “has collapsed,” to quote one prominent media outlet.

“And with sellers keeping prices artificially high (after all, most of them don’t really need the money right now, and are just dangling asks for desperate buyers to lift) the actual number of transactions has collapsed, as the number of price indiscriminate buyers has cratered, leading to widespread market paralysis.”

(Related: For the first time since the 2008 financial crisis, investors holding top-rated debt backed by commercial real estate [CRE] are suffering losses.)

Housing hits 3.3 months of supply, a record for this time of year

Late spring and early summer are normally when the most home sales occur, and yet right now in 2024 the available housing supply has hit 3.3 months, a record for this time of year.

What this means is that more homes are on the market than normal with fewer buyers than normal able or willing to buy them. At some point the ice is going to crack – the question is, how big will the collapse end up being?

Market demand for housing has reportedly plunged 17 percent year-over-year, which is driving some sellers to slash prices. In 2022, a record 55 percent of homes sold above listing price. Since that time, sales above asking have plunged to just 32.3 percent.

“And perhaps the most important data point: while in the past sellers had the luxury of just waiting out the lack of buyers, the first true crack in the market has finally appeared because sellers are finally starting to chase bids (which are not rising) and the number of listings that had price drops surged to 6.9%, the highest on record,” reported Zero Hedge about the changes taking place.

“That means that unless the Fed cuts rates significantly in the next few months, the housing market is on the verge of creating its own reflexive and self-reinforcing liquidation spiral, as more sellers cut prices, forcing even more sellers to cut prices until suddenly the specter of a full-blown housing crash returns … just in time for Trump’s presidency.”

In the comments, someone searching for a home to buy in Florida says prices are completely out of control for not just housing but also home and car insurance.

“Rate cuts will do NOTHING for what is going on here,” he writes about the dismal state of the American economy under the crushing weight of what appears to be the makings of hyperinflation.

The latest news about the imploding economy can be found at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

Bidenflation, Bidenomics, bubble, collapse, debt bomb, debt collapse, economic riot, finance riot, housing, housing bomb, Housing Market, inflation, Joe Biden, market crash, money supply, pensions, Real Estate, risk

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 FinanceRiot.com

All content posted on this site is protected under Free Speech. FinanceRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FinanceRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.