Iraq to DITCH U.S. dollar for oil trades, joining growing dedollarization trend

02/09/2024 / By Ethan Huff

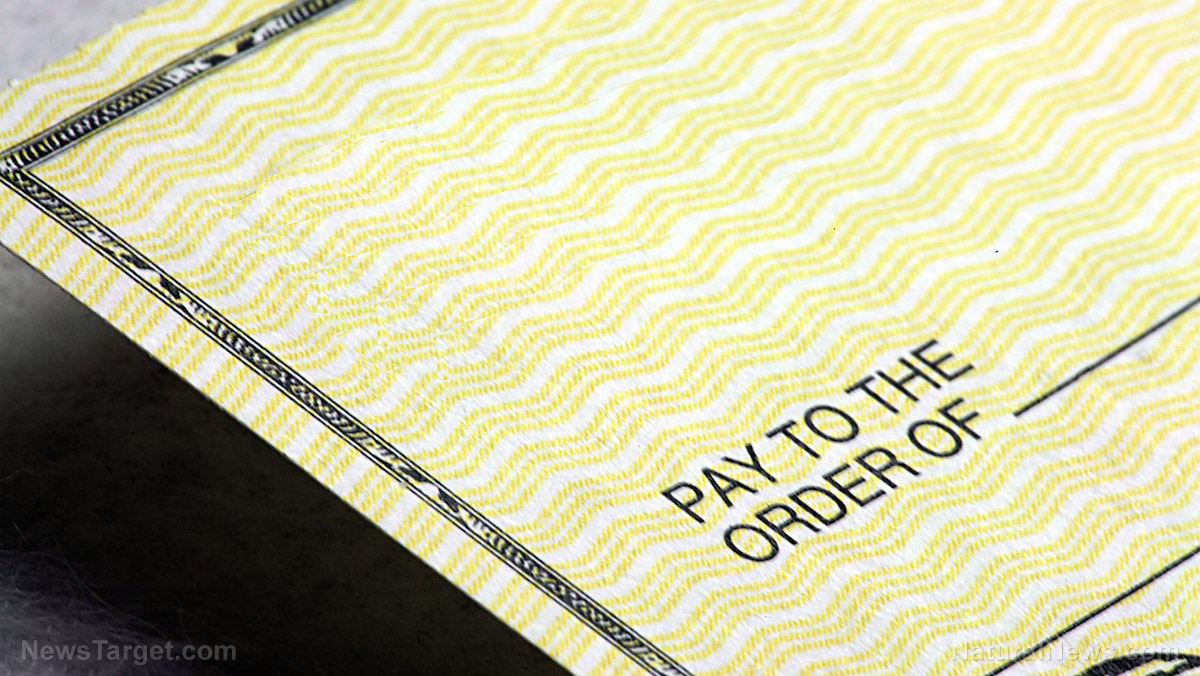

In an effort to dodge ongoing United States sanctions against its banking system, the finance committee of the parliament of Iraq wants all oil sales from here on out to be transacted in currencies other than the Federal Reserve Notes, also known as the U.S. dollar.

The committee released a statement chastising the U.S. government for making up excuses to sanction Iraq’s banking system in order to obstruct the stability of Iraq’s financial system at large.

“The U.S. Treasury still uses the pretext of money laundering to impose sanctions on Iraqi banks,” the statement reads. “This requires a national stance to put an end to these arbitrary decisions.”

“Imposing sanctions on Iraqi banks undermines and obstructs Central Bank efforts to stabilize the dollar exchange rate and reduce the selling gap between official and parallel rates.”

Iraq’s finance committee had previously called on both its government and central bank to take swift measures against U.S. dollar dominance by diversifying its cash reserves from foreign currencies. It reaffirmed this call on January 31, adding that the Iraqi government needs to take action immediately due to the repercussions of all this on the livelihoods of Iraqi citizens.

(Related: Back in late 2022, oil giant Saudi Arabia switched to China as its most “reliable partner” in trade – before that, America was Saudi Arabia’s top trade partner.)

Iraq wants the U.S. gone from its borders

The call comes after Washington imposed sanctions on Iraq’s Al-Huda Bank for allegedly laundering money for Iran. Similar sanctions were imposed on other Iraqi institutions over the past year based on the same allegations.

A top U.S. Treasury official issued a declaration around the same time that it expects Baghdad to assist in locating and sabotaging the financial resources of various resistance groups in Iraq that are funded by Iran.

“These are, as a whole, groups that are actively using and abusing Iraq and its financial systems and structure to perpetuate these acts and we have to address that directly,” the official claimed in a statement.

“Frankly, I think it is our expectation from a Treasury perspective that there is more we can do together to share information and identify exactly how these militia groups are operating here in Iraq.”

Three days prior to the Iraqi financial committee’s call to dedollarize Iraq’s oil trade, three U.S. soldiers lost their lives in an Iraqi resistance attack that occurred close to the Syria-Jordan border. Following the attack, the near-nonstop Iraqi attacks on U.S. outposts in Syria and Iraq came to an end as the Iraqi government put pressure on these resistance groups, including and especially the Kataib Hezbollah faction.

Baghdad continues to try to discreetly assist in the removal of U.S. troops from Iraq and the conversion of Iraq’s U.S. presence to an “advisory role.” As you might expect, Washington continues to resist these efforts.

Ever since Saddam Hussein’s regime was toppled by U.S. forces back in 2003, Iraq’s financial system has been dominated, in large part, by the U.S. Because of this, Iraq has had considerable troubles trying to repay its energy obligations to Iran amid strict sanctions.

The Federal Reserve Bank of New York also receives revenue from Iraqi oil sales, meaning Baghdad needs authorization from the U.S. to access these monies. Unsaddling itself from U.S. dollar oppression is now one of Iraq’s top agendas.

A government source who spoke with the Iraqi News Agency (INA) back in November indicated that Iraq is planning to carry out a number of economic initiatives aimed at fortifying the country’s own currency against the U.S. dollar.

Last May, the Iraqi government also said it will no longer accept the U.S. dollar for commercial or personal transactions.

The world is ditching the dollar at an accelerating rate. Find out more at Collapse.news.

Sources for this article include:

Submit a correction >>

Tagged Under:

big government, bubble, central bank, chaos, collapse, currency clash, currency reset, dedollarization, dollar demise, economic riot, finance riot, Iraq, money laundering, money supply, national security, oil, petrodollar, resist, revolt, risk, trade, uprising, US, WWIII

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2022 FinanceRiot.com

All content posted on this site is protected under Free Speech. FinanceRiot.com is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. FinanceRiot.com assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.